Indian Fertilizer Market: Trends, Challenges and Opportunities

India has a rich history of being an agricultural country. The agriculture sector plays a crucial role in the country’s economy. Not only does it ensure India’s food security, but also employs a large portion of its population.

The Indian fertilizer market holds immense significance in supporting the growing agricultural requirements of the nation. It is like a cornerstone of India’s agricultural industry.

This report gives an overview of the Indian fertilizer market. It offers insight into its market size, trends, current challenges, and opportunities.

Indian Fertilizer Market Overview

The young history of the Indian fertilizer industry dates back to the Green Revolution in 1960. Over the years, it has witnessed several ups and downs. Several factors, such as population growth, growing demand for food, and government programs influence its growth rate.

In 2022, the Indian fertilizer market was valued at INR 999.40 billion. It is expected to achieve a value of INR 1459.95 billion by 2029. This growth would happen with a CAGR of 5.7%.

While India is expected to produce 50 million metric tons of fertilizer by 2026, it will depend on other countries for other fertilizer types.

The forecast indicates that the Indian fertilizer import will attain a volume of 8.5 million metric tons by 2026. It would grow by 4% annually.

There are several key players in the Indian Fertilizer industry. It includes both government and private entities. National Fertilizers, Rashtriya Chemicals & Fertilizers, Tata Chemicals, and IFFCO are a few names to take.

Current Trends of the Indian Fertilizer Market

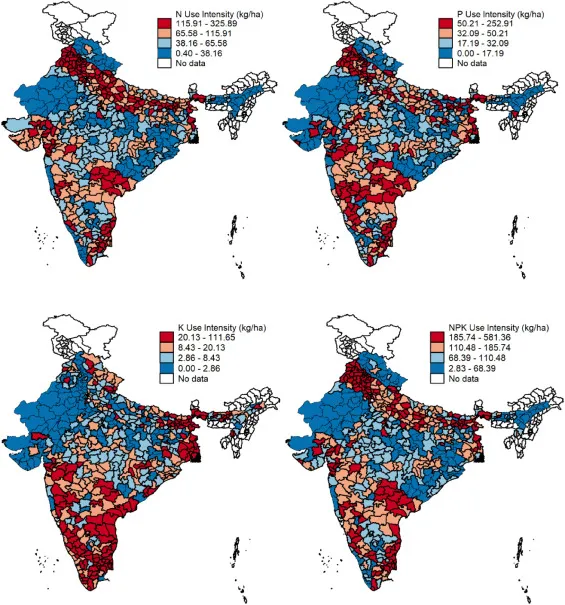

- Lately, India has started making balanced use of fertilizer. Government programs are promoting the use of potassic and phosphatic fertilizers to enhance overall soil health.

- The government is planning several reforms in fertilizer subsidies.

- Farmers are preferring eco-friendly fertilizers over chemical fertilizers. It is helping in downplaying the environmental impact of farming.

- Indian farmers are adopting customized fertilizer blends that meet specific nutrient requirements of crops and soils.

- The increase in the global fertilizer price and supply chain disturbance are impacting the fertilizer market in India.

Challenges of the Indian Fertilizer Industry

Dependency on Government Subsidies

The Indian fertilizer market is heavily dependent on the government for subsidies. This aid is indeed necessary to provide farmers with affordable fertilizers, but it puts a huge financial burden on the government.

According to a report, Russian companies have stopped providing fertilizer to India at discounted prices. Now the Indian government won’t be able to buy dis-ammonium phosphate (DAP) from Russia at a reduced cost. It will surely increase the import costs and subsidy burden on the government.

The key point is that the country’s fertilizer import from Russia was about 4.35 million metric tons during the financial year 2022-23. According to officials, Russia was offering DAP at $80 per ton, but the current price is $570 per ton on a cost and freight basis. This rise in the DAP price is due to tight global supplies.

Environmental Impact of Chemical Fertilizer

Another big challenge for the Indian fertilizer market is the negative impact of chemical fertilizer on the environment. As per the report of Times of India, excessive use of chemical fertilizers is causing issues like water pollution and soil degradation. Therefore, authorities are promoting eco-friendly and organic fertilizers.

Technological Limitation

While government initiatives are making numerous improvements, the industry needs to adopt more innovations. The Indian fertilizer market must focus on innovating new fertilizer formulations. More Research and Development investments can help them meet the ever-changing requirements of the agriculture industry and farmers.

Distribution of Fertilizer

The Indian fertilizer market needs extensive improvement in its distribution network. In rural areas, timely and affordable access to fertilizer is a big challenge. Improvement in fertilization transportation and distribution is necessary to confirm farmers are receiving them when needed.

Quality Control

Identifying and abolishing the presence of adulterated fertilizer is another massive obstacle to the growth of the Indian fertilizer sector. Fertilizer quality control in the country needs a systemic change.

The fertilizer control order, under section 3 of the Essential Commodities Act, requires compulsory registration for fertilizer manufacturers, dealers, and importers.

While several policies are imposed to control fertilizer quality, additional stringency is required.

Opportunities in the Indian Fertilizer Market

Though the Indian fertilizer sector has several challenges, they present various opportunities.

Organic Fertilizers

In the past couple of years, India has observed substantial growth in organic farming. During 2021-2022, the country used 4.73 million hectares of land for organic farming. The government has launched various schemes to promote organic agriculture in India.

Parampargat Krishi Vikas Yojna is one promising program being run by the Indian government. Still, total farmyard manure produced in the country can accomplish only 3% of the country’s requirements. It’s an excellent opportunity for agriculture-based startups to invest in an organic fertilizer production line and fill the gap.

Technological Advancements

Indian fertilizer companies have been embracing numerous technological advancements. Indian Farmers Fertilizer Cooperative Limited (IFFCO) launched a Nano-technology product range in 2019. They did experiments on minimizing the use of chemical fertilizer by launching products like Nano zinc, copper, and nitrogen.

Many agriculture-based startups are coming up in the industry with promising fertilizer business plans. For example, Ecofinix is one startup that converts waste into organic fertilizer. So

possibilities are endless in this sector.

Export Potential

India indeed imports certain types of fertilizer, it can become a primary exporter of fertilizer. According to a stat, fertilizer production will reach 50 million tons by 2026.

However, Indian fertilizing firms need more international collaborations to enhance their export potential. Furthermore, adherence to international quality standards is crucial to meet this expectation.

Data-Driven Solutions

Since digitalization is on the rise in India, fertilizer companies have the opportunity to embrace this technology. Data-based analytics in the agriculture industry can bring numerous data-driven solutions for farmers.

Final Words

The Indian fertilizer market is growing substantially, thanks to the government’s initiatives and technological advancements. Moreover, environmental concerns are changing the way fertilizing companies operate. The rising demand for organic food will open up a heap of opportunities for bio-fertilizer manufacturers.

Related Articles :

Cost & Profit Analysis of Organic Fertilizer Production Line

How Much A Complete Organic Fertilizer Production Line Cost?

Organic Fertilizer Production Line Ultimate Guide in 2023

Talk to An Expert

SHARE THIS POST

Talk to An Expert